how much is virginia inheritance tax

For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance tax. Virginia Inheritance and Gift Tax.

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

56 million West Virginia.

. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. State inheritance tax rates range from 1 up to 16.

2193 million Washington DC District of Columbia. In 2021 federal estate tax generally applies to assets over 117 million. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal.

Theres also no gift tax in Virginia. Price at Jenkins Fenstermaker PLLC by calling 866 617-4736 or by. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

So if your estate. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. No estate tax or inheritance tax.

Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. If the estate is appraised for up to 1 million more than that threshold the estate tax can be in excess of 345000. The federal gift tax exemption is 15000 per recipient each year for.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

While other local jurisdictions have an exemption that is lower Virginia does not. Virginia does not have an inheritance tax. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. The top estate tax rate is 16 percent exemption threshold. Today Virginia no longer has an estate tax or inheritance tax.

Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question. The loss of a loved one is painful but navigating the tax implications of transferring or inheriting an estate need not be your burden alone. Virginia Estate Tax 581-900.

Whereby this Commonwealth is given reasonable assurance of the collection of its inheritance or death taxes interest and penalties from the estates of decedents dying. Pennsylvania has a tax that applies to out-of-state inheritors for example. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

Virginia taxes capital gains at the same income tax rate up to 575. No estate tax or inheritance tax. Surviving spouses are always exempt.

States may also have their own estate tax. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Most often this is a 1 state tax and 033 local tax for every 1000 within the estate.

There is no federal inheritance tax but there is a federal estate tax. The federal estate tax exemption is 5450000 for decedents dying in 2016. Inheritances that fall below these exemption amounts arent subject to the tax.

The top estate tax rate is 20 percent exemption threshold. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Virginia doesnt have an inheritance or. No estate tax or inheritance tax.

Virginia currently does not have an independent estate tax that is lower than the federal exemption.

Regardless Of The Probate Court Or Law Enforcement S Actions You May Also Have Grounds For A Civil Lawsuit Against The Exe Probate Civil Lawsuit Estate Lawyer

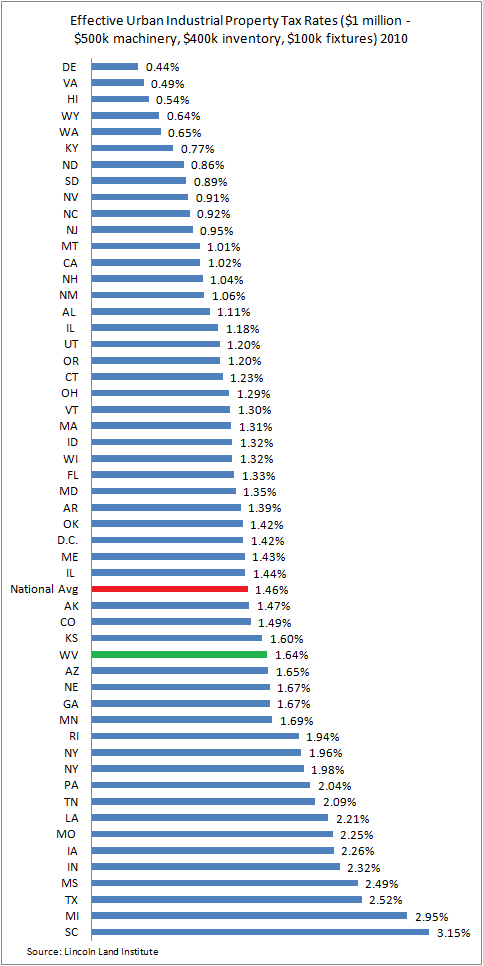

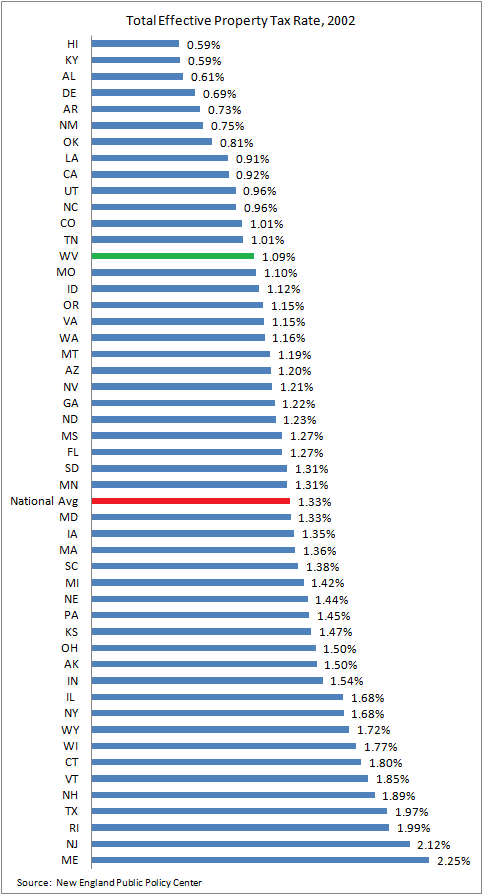

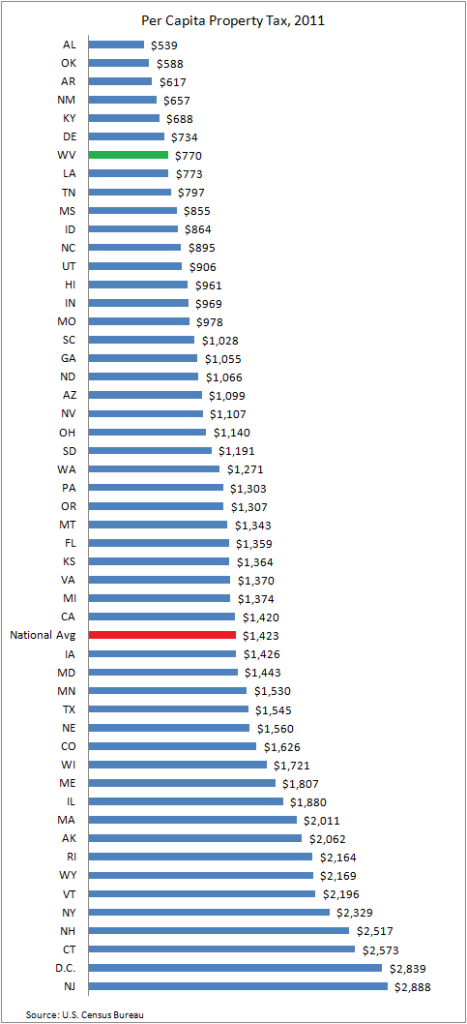

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Virginia Dpb Frequently Asked Questions

Differences Between D C Virginia And Maryland Washington Dc Coldwell Banker Blue Matter Virginia Washington Maryland

Virginia Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Virginia Estate Tax Everything You Need To Know Smartasset

Sale Of Residence Real Estate Tax Tips Internal Revenue Service Estate Tax Internal Revenue Service Real

Pin By Toni Phillips Mackain Bremner On Relocation Reirement In 2022 Beach Communities Folly Beach South Carolina Island Lighthouse

Virginia State Taxes 2022 Tax Season Forbes Advisor

Virginia Dpb Frequently Asked Questions

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

Legacy Assurance Plan Avoid Probate Probate Personal Injury Estate Planning Checklist

Where S My Kentucky State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

How Will You Sell Yours In 2021 Sell My House Fast Estate Agent We Buy Houses